Good News This Week

Birkenstock IPO, New Relic 6.5B all-cash deal, Series B+ deals are happening, new fund announcements

Good news is defined by all things liquidity, new capital infusions and other wholesome content on people making the world more wonderful.

IPO & Liquidity News:

Birkenstock, a 250 year old German company is planning for an IPO in September at between an $8-$10B valuation. Birkenstock is owned by L.Catterton, a private-equity firm with $30B+ AUM. No details yet on the date or size. There have been roughly 150 IPOs since the start of 2022, down from 416 in 2021. Why now? A scene in Barbie showing off a $160 pair of Birks . Read more here.

Tiger Global sells remaining shares in Flipkart totaling 1.4B to Walmart

M&A:

New Relic, a pioneer in the observability market sold for 6.5B in an all-cash deal this week to Francisco Partners and TPG. The purchase price at $87.00 per share represents a roughly 30% premium to New Relics last 12 month weighted average closing price on July 28, 2023.

Venture Deals:

Inspectify - (one of Wischoff Ventures portfolio companies) raises an additional $5.7M to power property inspection services

Haus, a growth command center combining causal inference with experimentation & AI, raised $17 million in Series A funding.

Neon raises another $46M to advance serverless PostGreSQL database for the AI era

Divirod, a real-time flood management and water risk analytics company, raised $3.6 million in bridge financing.

Datasaur, a platform that helps companies build machine learning models automatically, raised $4 million in seed funding.

Knot, a platform that helps people find and book last-minute travel experiences, raised $10 million in Series A funding.

Lula, an insurtech startup that aims to be the "Stripe for insurance," raised $35.5 million in Series B funding.

Kyverna Therapeutics, a biotech company developing gene therapies for eye diseases, raised $60 million in Series B funding.

Acelab, a company that develops software for the semiconductor industry, raised $5.3 million in Series A funding.

Flyte, a platform that helps businesses automate their marketing campaigns, raised $2.68 million in seed funding.

Source, a marketplace for commercial construction products, raised $8.5 million in Series A funding.

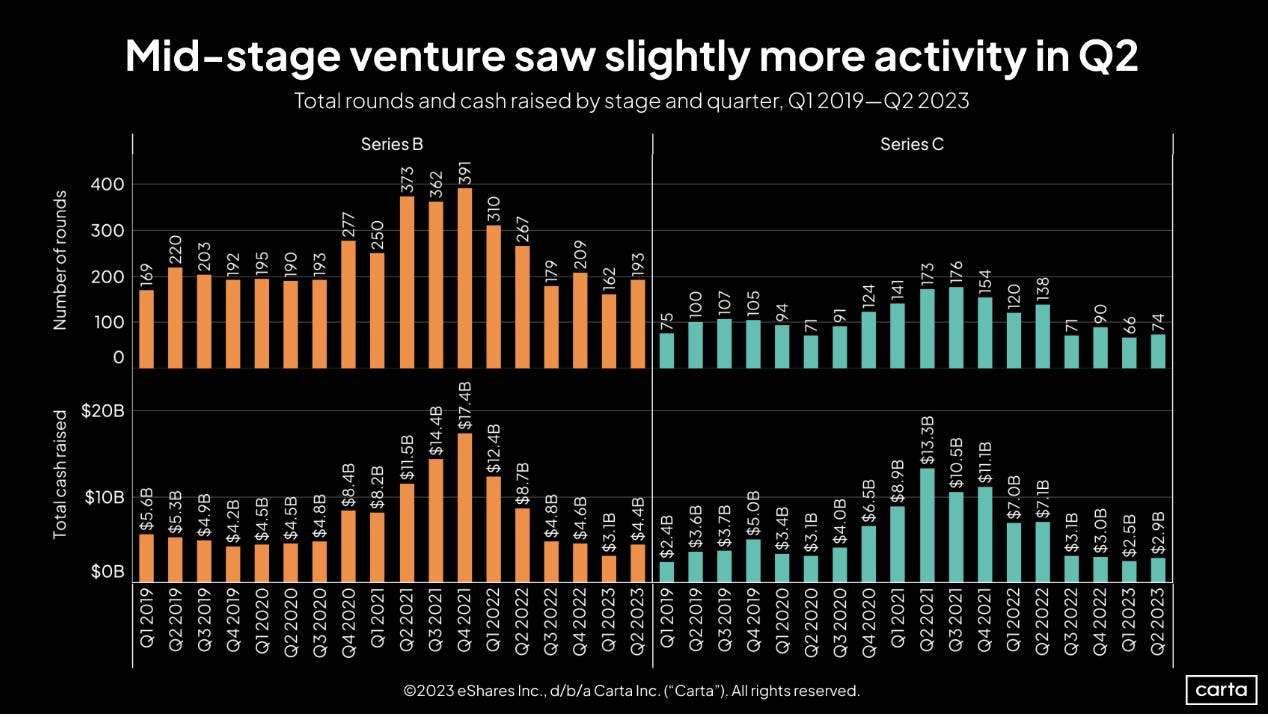

Carta Q2 Data: Growth Stage (Series B+) funding is back on the rise. Slow and steady but hoping that Q1 was rock-bottom. Seeing it ^

Venture Capital:

Reed Jobs, Steve Jobs son is branching out on his own from Emerson Collective to start Yosemite, a venture firm focused on cancer treatments. The firm structure is unique. It is a for-profit business while maintaining a donor-advised fund to make grants to scientists. The fund is aiming for $400M.

Ben Horowitz and Marc Andreessen launched a new podcast called “The Ben and Marc Show”. No clue what to expect from it but love hearing from billionaires with strong opinions. Unclear the cadence of these episodes but we will see.

American Family Closes on a $444M Fund IV comprised of only 21 LPs. AmFams investment thesis revolves entirely around the insurance software category.

Epic Things:

Superconductivity - LK-99 and the race ahead

Tech Jobs:

Checkmate - Affiliate Lead & Software Engineer (Series A stage co, backed by Google Ventures and Wischoff Ventures)

Ansa - Full stack engineer, Frontend Engineer, Founding Product Designer, GTM Lead, Customer Success + Operations, Commercial Operations Manager (seed stage co, backed by Bain Capital and Wischoff Ventures)

Loop - Engineering, Product, Customer Success (Series B stage co, backed by Founders Fund, 8VC, Wischoff Ventures)